Get Started With

servzone

Overview

Auditing is not always related to inspection of accounts and financial records. In general, this means that proper scrutiny and verification of the company's process, records, efficiency, data, etc., is related to compliance with the secretarial audit applicable rules and regulations. Secretarial audit ensures regulators, stakeholders and even employees that the company's management is compliant and has a disciplined approach, risk management, internal controls and governance processes. Let us learn more about secretarial audit in detail.

About the secretarial audit

There is legal compliance for secretarial audit monitoring and verification that the company complies with the rules and obligations applicable to it. Secretarial audit plays an important role in periodically checking for errors and mistakes and establishing a strong compliance mechanism in the unit.

Every company has many rules and laws to follow under the Companies Act 2013. Hence periodically, the audit shows accurate information about the law applicable to the company and how to comply with such provisions of that law.

process of secretarial audit

There are no such difficult and fast steps for inspection, although the following steps are normally followed by an auditor while performing an audit:

- Discuss with the management about the scope of work and professional fees provided for conducting such audit

- Once the primary object is set, the scope and activities must be identified

- After discussing and finalizing PCS, the company will issue an appointment letter containing the terms and conditions of its appointment

- PCS will plan ahead of the process for audits such as areas of law it will cover first, date of visits to audit, approximately months or days will be required for completion, etc.

- Conducting the audit and keeping in mind the overall observations and searches made during the audit

- Once the audit is completed, the final audit report in PCS format will be duly signed and stamped to MR-3, which is in practice by the Company Secretary

Scope of Function

The secretarial auditor must check compliance under the following provisions of the law:

- Companies Act 2013

- Securities (Contracts) Regulation Act

- Depository Act

- FEMA

- Securities and Exchange Board of India

- SEBI (LODR) Regulations

- Labor Law

- Environmental Law

- Provisions relating to compliance of taxation such as Tax Audit, Income Tax Act, GST, etc.

- PF / ESI

Importance

Section 204 (1) of the Companies Act 2013 regulates the scope, procedure, applicability etc. related to secretarial audit. Hence audit is mandatory for lower class of companies:

- All listed company

- Unlisted public company with paid up capital share of more than INR 50 crores

- The unlisted public company has a turnover of more than INR 250 crores

- Private company which is a subsidiary of an unlisted public company:

• paid-up above INR 50 Crore

• turnover above INR 250 Crore

Documents

- Charter Documents and Statutory Registers,

- Board and General Meeting Minutes & Notices,

- Audited financial statements and Last year Secretarial Audit Report,

- If the company is listed, Filings & Intimations with ROC, Stock Exchanges, Newspaper Advertisements.

- Annual Performance Reports, Lease Deed, Bonds and returns

- Filings with RBI (If there is a foreign investment) and other statutory departments,

- Registers maintained under Labour Laws

- Admission and Statement for code of conduct received from the directors

- Remuneration and Sitting fees details paid to directors.

- Particulars of CSR amount

- SAST Disclosures

- Bank account details for dividend

- Details of ECB Returns, in case of foreign borrowings in the company.

various fields in secretarial audit

- For listed entities: Secretarial audit is mandatory for listed entities by SEBI. These companies will audit themselves through PCA / PCS. During the audit, PCS will consolidate the details of CDSL / NSDL as well as the shares held

- For the Central Public Sector: The Ministry of Heavy Enterprises and Public Enterprises has made it mandatory for corporate governance of CPS Undertakings.

- For Banks: RBI recommends due diligence for banks and they will buy a certificate from practicing professionals stating the level of compliance

- For unlisted public / private company: Audit of such company is done once a year. And the ROC is required to submit reports that are given by practicing professionals

Who are the Beneficiaries of Secretarial Audit?

Frauds and Penalties

Section 448 of Companies Act 2013, deals with the penalty for false statements. The section provides that if in any return, report, certificate, financial statement, prospectus, statement or other document required by, or for the purposes of any of the provisions of this Act or the rules made thereunder, any person makes a statement,—

- Which is false in any material particulars, knowing it to be false; or

- Which omits any material fact, knowing it to be material, he shall be liable under section 447.

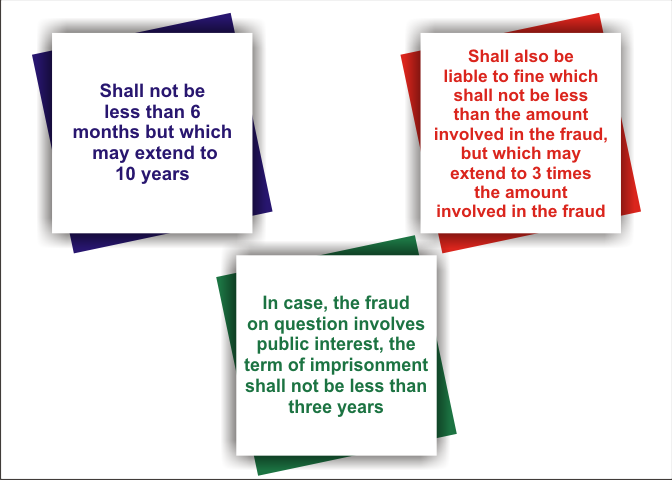

Section 447 deals with Punishment for Fraud

It provides that any person who is found to be guilty of fraud, shall be punishable with imprisonment for a term which-

In terms of Section 448, a PCS is liable to attract penal provision if, he makes statement in the Secretarial Audit Report which is false is any material particulars, knowing it be false or omits any material fact knowing it to be material.

Auditor

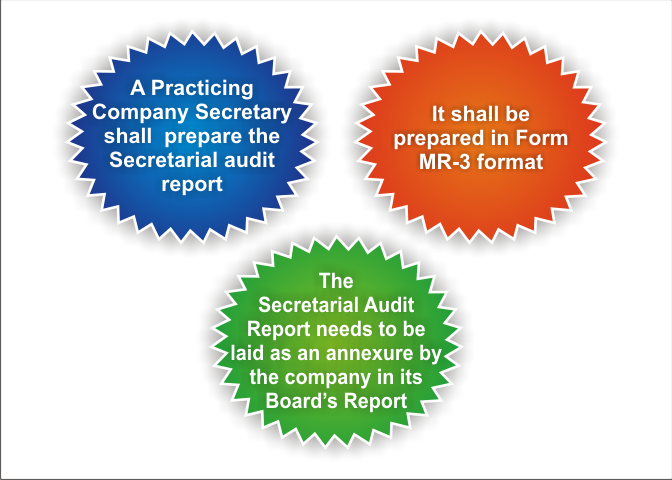

Section 204 (1) states that secretarial audit can be conducted only by the secretarial auditor who is a member of the Institute of Company Secretary India (ICSI), who holds a valid Certificate of Practice (COP), i.e. Practicing company secretary is allowed. May be appointed as the secretarial auditor of the company.

The company will have to pass a board resolution duly at the board meeting to approve the appointment of the auditor and the conditions of his appointment. The resolution for such appointment will be filed with the ROC through filing of e-Form MGT-14 within 30 days of appointment.

It is advised, the company has to appoint a secretarial auditor at the commencement of the financial year so that the appointed auditor can verify the company for the whole year. After completion of the audit, the secretarial auditor shall submit its audit report in the prescribed format of Form No. MR-3 to be attached to the Board's report.

GST Registration

PVT. LTD. Company

Loan

Insurance